Epf Member Portal: Each employee of the Employees’ Provident Fund Organisation (EPFO) is given a UAN (Universal Account Number), a 12-digit number issued by the Ministry of Employment and Labour under the Government of India, via which he can manage his PF accounts.

If you are a salaried worker and must make a required contribution, you become a member of the EPF.

Every recipient of the Employees’ Provident Fund (EPF) Scheme has received a Universal Account Number (UAN), as was already mentioned. With the use of this 12-digit UAN, an employee is able to link all of his PF accounts from several companies and access them through the UAN Login Portal.

A member of EPF can discover his KYC information, service history, UAN card, etc. on this portal. The EPF member e-Sewa site has made it simpler to transfer and withdraw provident fund funds.

Table of Contents

UAN Member Portal for Employee

You must first have a UAN that is active. To do so, go to the EPFO Member Portal, select “Activate UAN,” and then enter your UAN, member ID, mobile number, Aadhaar, name, and birthdate. To get the PIN delivered to the registered mobile number, click “Get Authorization PIN”.

Create a username and password for the UAN site after entering this PIN to confirm the validity of your request. The steps to access the UAN Member Portal for Employees are shown below:

- Visit EPFO Website

- Go to ‘Services’ and select‘For Employees’

- Now, navigate to ‘Member UAN/Online Services’

- On the redirected page, enter all the required details- UAN, password and the captcha code

- Click on ‘Sign in‘ to login to EPF member portal.

UAN Member Portal for Employer

Employers can log in to the EPFO site using a procedure that is almost identical to that used by employees. Here are the actions:

- The employer must go to the EPFO Employer Login website, which displays the Establishment panel. ‘Sign In’ using your username and password is located on the right side of the page.

- The main page of the employer’s EPFO portal will be the following page, where the employer can approve the employee’s KYC information.

The establishment or the employer must have registered the establishment online through the Shram Suvidha Portal in order to engage in the aforementioned procedures.

How to Register at UAN Member Portal

You need to activate your UAN before logging into UAN Login Portal. You have to follow the steps mentioned below :

- Visit EPF Member Portal

- Click on the “Activate UAN” present in the “Important Links” section

- Enter your details and click on “Get Authorization PIN”

- A PIN will be sent to your mobile number registered with EPFO

- Enter this PINto activate your UAN account

- A system-generated password will be sent to you through SMS

- You can now login to your EPF account using your UAN and password

Know your UAN Status

In order to know your UAN status, an employee with an EPF account can follow the steps given below:

- Visit the UAN portal:https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Click on ‘Know your UAN’button

- Enter your mobile number, captcha code and click on ‘Request OTP’

- An OTP is sent to your registered mobile number. Enter the OTP and the captcha code and click on ‘Validate OTP’

- You can choose to enter your Member ID, PAN or Aadhaar. If you choose the member ID option then other details such as the state you reside in and your office will have to be filled in. Your member ID and pin are available on your salary slip.

- You will also have to enter other details such as date of birth, name and the captcha code.

- Click on ‘Show My UAN’and your UAN is displayed to you.

How to Reset Password at UAN Member Portal

Follow these steps to reset your EPF member login password :

- On the UAN member portal,click on “Forgot Password” in the login section

- Now enter your UANand captcha code

- Enter your name, date of birth, gender and click on “Verify”

- Next, fill in the captcha code, Aadhaar number, give your consent for Aadhaar-based authentication and click on “Verify”

- Enter your Aadhaar-linked mobile number, give consent and click on the “Get OTP” button

- Fill in the captach code that you see on your screen and the OTP that you receive and click on “Verify”

- Enter your desired new password, confirm the password and “Submit” it to use this password to login to the UAN portal

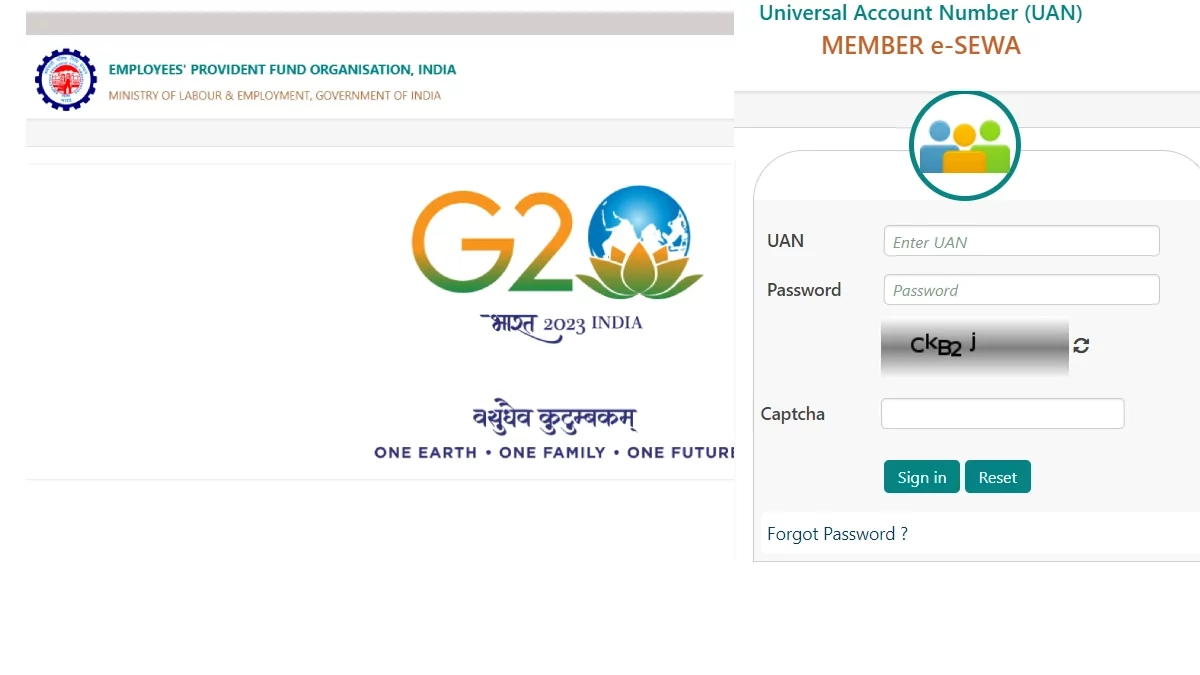

UAN Member e-SEWA Portal Login Process

Once you have logged in, you will be able to view your UAN Card, Profile and Service History. Given below is the stepwise process to login to the EPFO member portal or EPFO/UAN member e-Sewa portal:

- UAN Member e-Sewa page

- Enter your UAN, password and captcha code

- Click on ‘Sign in’to log in to the EPFO UAN member portal.

UAN Login e-Sewa Portal Services

The EPF UAN Login Portal offers you comprehensive services related to your EPF account. Here’s all you can do –

A. View

On the portal, you can view information related to your EPF Account. There are four types of information you can view on the EPF member portal –

1- Profile- Your complete EPF profile is available on the Portal. You can check the same under the ‘View’ tab.

Clicking on ‘Profile’ will lead you to your profile page which contains information such as-

- UAN

- Name

- Date of Birth

- Gender

- Father’s/Husband’s Name

- Mobile Number

- Email ID

- Whether you are an international worker

- Qualification

- Marital Status

- Differently abled or not

Out of the above information, only the mobile number and email ID can be edited by you.

2- Service History

No matter how many companies they switch to over their lifetime, each person is only given one UAN. So that the person’s complete EPF contribution may be managed consistently and in a more transparent way, the same UAN is to be provided into the system by various companies.

Despite the fact that the UAN stays the same, each organisation you work with must set up a new PF account using the same UAN.

The following details for any businesses you have previously worked with, including the one you are now working with, are displayed in the website’s “Service Details” section:

- Member ID

- Name of the Member

- Name of the Establishment

- Date of Joining EPF

- Date of Ending EPF

- Date of Joining EPS (Employee Pension Scheme)

- Date of Ending EPS (Employee Pension Scheme)

- Date of Joining FPS (Family Pension Scheme)

- Date of Ending FPS (Family Pension Scheme)

3- UAN Card

UAN Card can also be viewed and downloaded from the UAN login Portal. This facility is also available under the ‘View’ menu. This card can also be downloaded and presented at the PF office at the time of offline withdrawal or transfer.

4- EPF Passbook

A passbook option is also made available under the ‘View’ menu. However, the member portal does not offer this capability. Visit the website www.epfindia.gov.in and take the steps outlined below to view your UAN member portal passbook.

- Under the Services menu, select the ‘For Employees’ option

- Click on ‘Member Passbook’.

- Now you will have to enter the UANand Password (the same as e-Sewa Portal)

- Click on the Member ID of your current PF account to access the passbook.

B. Manage

Apart from just viewing the information as given above, you can also manage and modify a few of the details on your own.

1- Email ID and Mobile Number Registration

Your contact information can be managed on the member website. An authorization pin will be issued to the new number in order to change the contact number.

Your mobile number will be updated once you enter the pin in the designated space. On the UAN Member Login Portal, updating a new email ID requires similar procedures.

2- KYC

A member of EPF can also update other KYC details such as –

- Bank Account

- PAN

- Aadhaar

- Passport

KYC details are first verified with the concerned authorities and then updated against the member’s UAN.

C. Online Services

Various online services can also be availed such as-

1- Claim (Form 31, 19 and 10C)

The Employees’ Provident Fund Organisation (EPFO) has launched new composite claim forms with effect from February 2017 to make it easier to withdraw all or part of your PF. The three forms in this claim section are Forms 31, 19, and 10C.

Moreover, an employee should be aware that Aadhaar and UAN must be linked in order to use the Composite Claim Form to request a complete or partial withdrawal.

2- Transfer

You can also request the transfer of your PF amount from the previous account into the current one. Before applying for a PF transfer on the Portal, you should make sure that-

- Your KYC details updated on the website are correct

- Your previous/current bank account details and IFS Code is seeded into the UAN database

- KYC Details are seeded against the UAN

Employees should know that only one transfer request can be claimed on the previous PF account.

3- Track EPF Claim Status

On the UAN Login Portal, one can also monitor the progress of an EPF claim. The status of any requested claims may be seen in the “Track Claim Status” section. No acknowledgment number or PF account number is required to be entered.

UAN Customer Care

If a member of EPF is facing difficulty in logging into the Member Portal, he/she can reach out to the customer care team of UAN. The customer support team can be reached via-

- Toll-Free Help Desk- 1800 11 8005

- Email ID- employeefeedback@epfindia.gov.in

- Raise an issue on the website via the EPF i Grievance Management System

- EPFO Regional/Sub Regional office (You can view the directory here- http://www.epfindia.gov.in/site_en/Contact_us.php)

Please note that the help desk service is available from 9:15 AM to 5:45 PM.

Features of UAN

- UAN remains the same even when if you change jobs

And also, it is challenging to manage many PF accounts under various employers, hence the UAN was implemented to retain integrated information about all Provident Funds.

You need to inform your new employer of your UAN number when changing jobs. It is therefore necessary to link your new PF account to your UAN if your account is an older one.

- Your UAN number is assigned and stays with your employer

However, generally the employers inform the UAN as they credit the amount to Provident Fund Accounts. If they don’t, you can know your UAN by logging in to the EPFO UAN Member Portal. It is possible if your PAN, AADHAAR, and mobile numbers are linked with UAN .

- UAN provides ease in changing personal details

One may need to change or update the contact and address details when changing the job or shifting to a new city. With UAN , the process becomes easier as all details are at one place that need to be edited.

- UAN helps in convenient money withdrawal

When all PF accounts, even the previous ones with old jobs are registered under one UAN, the money withdrawal becomes very convenient for the employee. Thus, it gives a simplified system to save time and to keep a track of payments and withdrawals.

Advantages of UAN

Here are a few key advantages of UAN to the employees:

- Less Employer Involvement in withdrawals of PF: With UAN, the employer involvement has been reduce as the PF of the old organization will be transferr to the new PF account once KYC verification is complete.

- Fund Transfer Not Require: The employee needs to give his UAN details and KYC to the new employer and the old PF is transferr to the new PF account once the verification is done.

- Easily Managed by SMS alerts:Employees receive SMS whenever the employer makes a contribution after registering at the UAN portal.