RJN Stock: This exchange-traded note issued by the Swedish Export Credit Corporation is linked to Rogers International Commodity Index – Energy Total Return.

The Index represents the value of a basket of 6 energy commodity futures contracts and is a sub-index of the Rogers International Commodity Index.

Table of Contents

What Is Strike Energy Ltd?

Does the January share price for Strike Energy Limited (ASX:STX) reflect what it’s really worth? Today, we will estimate the stock’s intrinsic value by estimating the company’s future cash flows and discounting them to their present value.

One way to achieve this is by employing the Discounted Cash Flow (DCF) model. Before you think you won’t be able to understand it, just read on! It’s actually much less complex than you’d imagine.

Companies can be valued in a lot of ways, so a DCF is not perfect for every situation. If you still have burning questions about this type of valuation, look at the Simply Wall St analysis model.

We are going to use a two-stage DCF model, which, as the name states, takes into account two stages of growth. The first stage is generally a higher growth period which levels off heading towards the terminal value, captured in the second ‘steady growth’ period. In the first stage we need to estimate the cash flows to the business over the next ten years.

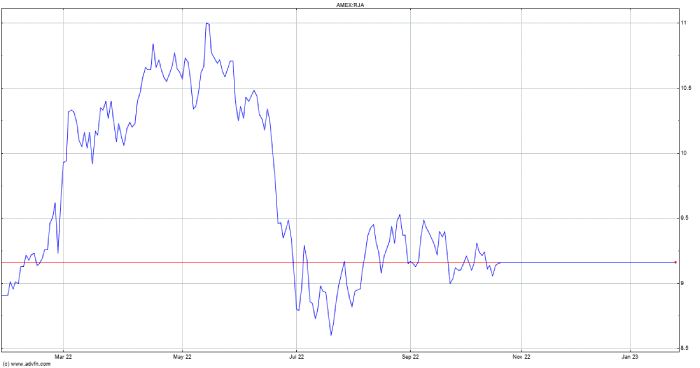

Rja Stock Forecast

AMEX stock RJA Rogers Agriculture forecast & share price targets are below. These share price targets & forecast are valid from short-term to mid-term to long-term. If you want tomorrow’s movements predictions for Rogers Agriculture then click here or Rogers Agriculture share price targets or view what Experts say about Rogers Agriculture or Announcements & NEWS by Rogers Agriculture

Rogers Agriculture RJA share price forecast & targets for short-term is a downtrend, and nearest possible share price target is 9.

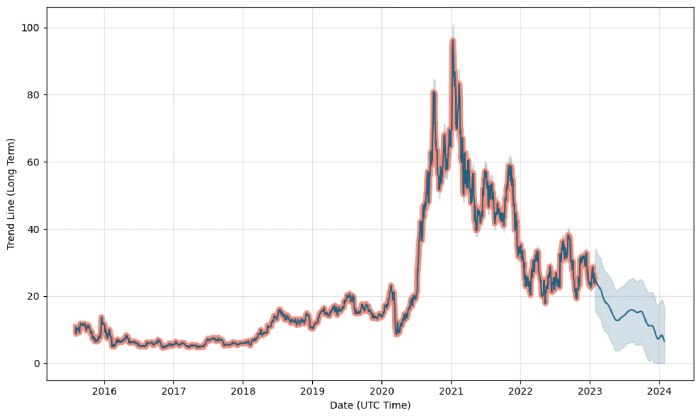

RJN Stock Price Chart

Want to observe and analyze Rogers Energy ETN Elements (RJN) stock price graphs for various time ranges in history? This report will help you.

You will find 6 useful sections in this report. Below is a table of contents to help you navigate quickly.

- Rogers Energy ETN Elements (RJN) 16 Years Stock Chart History

- RJN 10 Years Stock Chart

- Rogers Energy ETN Elements (RJN) Stock Chart 5 Years (Recent History)

- RJN Stock 3-Year Chart

- RJN Stock 1-Year Chart

- Rogers Energy ETN Elements (RJN) Stock 6 Months Chart

We have plotted the below chart using annual avg. prices instead of daily prices. Annual price chart can be thought of as a smoothened version of a daily price chart.

This type of smooth graph will give you a better understanding of the long term price movement of Rogers Energy ETN Elements (RJN).

RJN Top Holdings

However, one asset class that has historically proven resilient amid persistently rising prices is commodities. From energy sources to agricultural products to metals, commodities of many different flavors have naturally seen their values rise amid inflationary pressures.

As a result, several commodity stocks and commodity exchange-traded funds (ETFs) have been on a pretty profitable run for most of the last 12 months.

And while the latest consumer price index (CPI) reading showed inflation continues to ease, “the after effects of rapid inflation and rising interest rates will probably linger for some time,” says Nick Bennenbroek, international economist at Wells Fargo Securities.

Moreover, hard assets like commodities and commodity ETFs are increasingly seen as an important part of a diversified portfolio, either as a hedge against rising prices or as a way to access returns that are uncorrelated to the broader stock market. Still, engaging directly with commodity markets can be intimidating for investors.

RJN ETF Info

Pursues outperformance in developed market stocks that exhibit positive environmental, social, and governance (ESG) metrics

In August, F/m Investments, a $4 billion multi-boutique investment advisor, launched three single-bond ETFs: the US Treasury 10 Year ETF (UTEN), US Treasury 2 Year ETF (UTWO), and US Treasury 3 Month Bill ETF (TBIL)

They’re the first single-bond exchange-traded funds launched to date. Single-stock ETFs, which began hitting the market earlier this summer, offer traders exposure to the daily performance of one stock. They have been criticized for their greater volatility and having few benefits for the investor.

However, in an August Bloomberg op-ed, Jared Dillian, senior editor at Mauldin Economics, argued that single-bond ETFs “will be one of the more successful product launches of the year.”

Meanwhile, these funds allow investors to easily trade Treasury securities, which are notoriously complicated. Many hedge funds and investors tend to stay clear of bonds. Which are associated with messy cash flows and institutional-sized lots, and focus on buying shares of trades on an exchange.

Moreover, alexander Morris, president and chief investment officer at F/m Investments, said, “bond math is hard.” He acknowledged it is off-putting to many to get 1099 amid coupon and accretion payments. But he said the ETF route gives investors direct access to these bonds while being easier to trade.

Conclusion

Rogers Energy ETN Elements stocks price quote with real-time prices, charts. Financials, latest news, technical analysis and A high-level overview of ELEMENTS Linked to the Rogers International Commodity Index – Energy Total Return (RJN) stock. Stay up to date on the latest rjn stock